Crypto trading volume

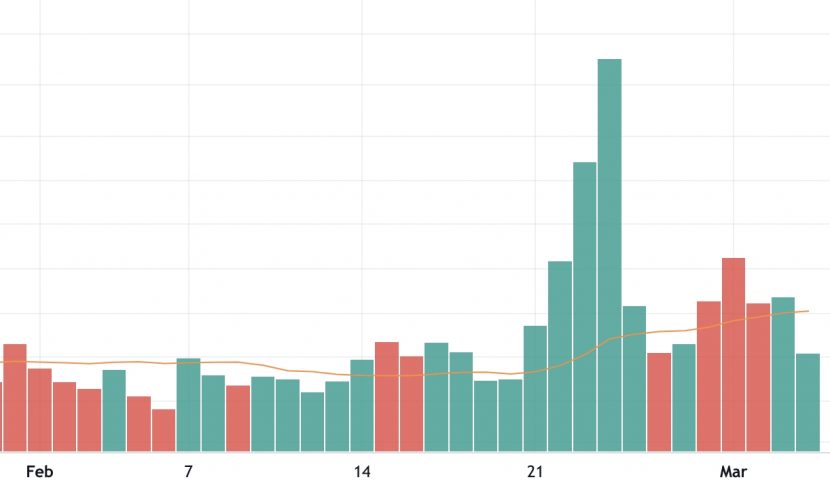

Crypto trading volume is a metric that shows how many times a coin changes hands over a period of time. The timeframe that is usually used for measuring is 24 hours. This metric is shown in a bar chart. Most commonly, volume is represented as green and red vertical bars on a histogram. The height of the bar reflects the volume, or turnover. Red volume defines a decline on a cryptocurrency exchange, while green volume represents an increase in coin prices.

High volume indicates that there is a lot of interest in a particular asset, which leads in an increase in price. High volume cryptocurrency trading indicates increase in price, and low volume usually means prices lowering. However, high volume doesn’t automatically mean higher price. Bear markets tend to have higher volume because many people are rushing to sell their coins. But, higher interest in an asset is always good for the investor because it brings more potential buyers and sellers.

Low volume indicates that there is a lack of interest in a particular coin, meaning the price will be lower. However, low volume can sometimes be beneficial for traders since price movement will be a lot more drastic. It can lead to higher risk, but also to a potential higher gain in profit.

How to calculate volume?

In order to calculate volume, the total value of a type of traded cryptocurrency needs to be determined. It is calculated by multiplying the number of traded coins by the price of each trade. For example, if the total amount of bitcoin traded on Binance in the last 24 hours was $15 billion, then the trading volume for bitcoin in that period of time was $15 billion.

Total volume

What does volume mean in crypto?

Total volume indicates how much the cryptocurrency can change its price. This liability to change is called volatility. Price can be defined as the balance of opinions between buyers and sellers. If the same amount of coins has been traded, then the prices will be stable. This is called market efficiency. Markets with high volume have more stability. But, the cryptocurrency market is always volatile because it’s still immature.

Relative volume

Relative volume represents how much volume is correlated with the movement of the price. That can help inform price direction.

Why is volume important?

Trading volume is important when it comes to determining the strength of the particular market. High volume indicates that there is a lot of interest in a particular coin. The trading is active and fast. Lower volume indicates a lack of interest in a coin.

The importance of volume becomes obvious when trading coins with low crypto liquidity. For example, a trader wants to sell one thousand coins, but the exchange has low volume. To sell one thousand coins, that could require going through many buy orders, each one being at a slightly lower price than the one before it. So, a trader would receive a lower price for his coins than the price he would have if the exchange had higher volumes.

Higher volume means higher price stability and less volatility.

Liquidity and volume

Liquidity is a measurement of how easy it is to buy and sell an asset. If a cryptocurrency can be sold without a problem at its trading price, it is called liquid. A liquid market has a lot of bids, but an illiquid market is the one where crypto holders can sell assets at a fair price.

Trading volume is important in determining liquidity. You are able to find traded value within a given time frame. When you look at the chart, you can assess the market’s interest in a particular cryptocurrency. Assets with higher trading volume have more chances to be traded more frequently, unlike those with low volume.

Volume indicators

There are various cryptocurrency volume indicators. Some of them include:

- The Total Volume Traded – the total amount of coins traded in a given period of time.

- The Dollar Value of All Trades – the total dollar value of all trades in a period of time.

- The Number of UNique Addresses Used – the number of unique addresses used to buy or sell an asset.

- The Percentage of Total Volume Traded – the percentage of the total volume that a coin represents.

- The Weighted Average Trade Size – the weighted average trade size of all trades in a given time frame.

- The Volume-Weighted Average Price – the volume-weighted average price of all trades in a period of time.

How to use volume indicators

Volume indicators have different purposes. Some can be used to measure liquidity or to predict the future price of a cryptocurrency.

Traders use volume indicators to help them determine when to buy or sell a coin. Also, the indicators are being used to help confirm other technical analysis signals. They can be used to predict prices in the future.

There is no one good indicator. They should be used together for best results.

How is volume evaluated?

To find the highest trading volume crypto, the traders should discover which coin has the biggest activity on a large number of exchanges. There are free online tools that provide an aggregate of total trading volume and that enable comparison of the activity of various assets in a given period of time.

It’s important to understand an order book. The order book is a list of the pending orders being placed on an exchange. On one side there are buy orders, and on the other side are sell orders. This shows current interest levels. It is a good indicator of a promising cryptocurrency. When the investors pull out of trading, they decrease volume and the price falls.

Can volume be faked?

On the crypto market, it is possible to fake volume. This is done by wash trading. The wash trading is when a trader buys and sells the same coin multiple times to fake a high volume. It is illegal in many markets, but sometimes it can be hard to detect it. People engaged in a wash trading can even use multiple addresses to hide their tracks.

What is the crypto with the highest volume?

Bitcoin is the crypto with the highest trading volume, followed by Ethereum.

The trading volume in cryptocurrency markets has great significance. It is an essential metric for the investors, when assessing the viability of a particular coin.

I think my life changed the day I learned about this amazing guy whom I share the name with - Aaron Savage. He was among the first people ever to advocate for freedom of information and the internet, and I feel he would support a great deal of decentralized finance idea if he was alive today. So, I am just another IT guy, super curious about crypto and writing my opinions and analyses here from time to time. Enjoy!